Global Market Trends and Financial Forecasting for 5702771043, 602191396, 648605029, 120006808, 910608225, 8333110849

Global market trends for identifiers 5702771043, 602191396, 648605029, 120006808, 910608225, and 8333110849 are increasingly shaped by economic indicators such as inflation, employment, and consumer spending. Geopolitical events further complicate market dynamics, influencing investor sentiment. Analyzing historical data will be essential for accurate financial forecasting. Understanding these factors and their interplay could reveal significant insights for investors navigating this complex landscape. What strategies might emerge to address these challenges?

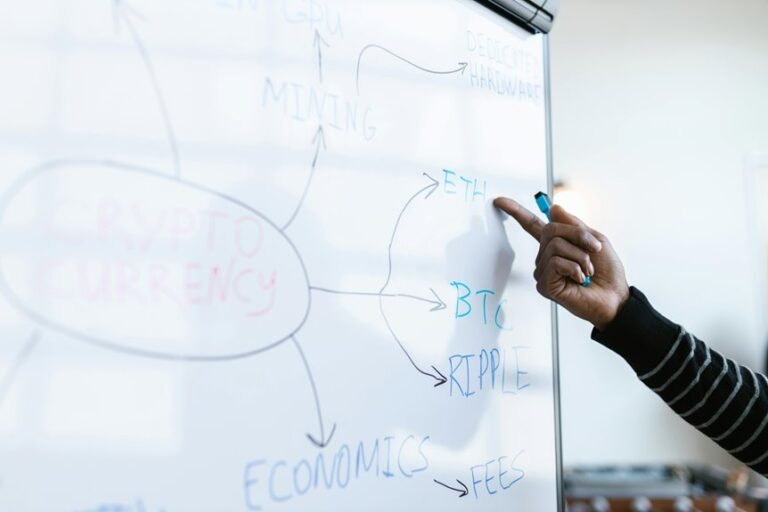

Key Economic Indicators Impacting Market Trends

Key economic indicators serve as critical barometers for assessing market trends, providing insights into the overall health of an economy.

Inflation rates influence purchasing power, while employment statistics reflect labor market dynamics.

Consumer spending drives economic growth, and interest rates affect borrowing costs.

Trade balances indicate international competitiveness, and currency fluctuations can impact export-import relationships, all of which shape market trajectories.

Geopolitical Events and Their Influence on Financial Forecasting

Although often overlooked, geopolitical events play a significant role in shaping financial forecasting by influencing market stability and investor sentiment.

Political stability fosters confidence, encouraging investment, while economic sanctions can destabilize economies, leading to increased volatility.

Consequently, analysts must consider these factors to accurately predict market movements, understanding that geopolitical dynamics directly affect financial landscapes and investor behavior.

Historical Data Analysis for Market Performance

Understanding the historical performance of markets is vital for effective financial forecasting. Analyzing historical market data allows analysts to identify trends and assess performance metrics over time.

Strategies for Navigating Market Challenges and Opportunities

As markets continuously evolve in response to global economic shifts, investors must adopt strategic approaches to effectively navigate both challenges and opportunities.

Key strategies include investment diversification to spread risk across various asset classes and robust risk management practices to mitigate potential losses.

Conclusion

In the intricate tapestry of global markets, the threads of economic indicators, geopolitical events, and historical data weave a narrative that shapes financial forecasting. As investors navigate this ever-shifting landscape, they must don the armor of diversification and wield the sword of risk management. Those who can interpret the subtle cues of market signals will emerge not merely as survivors but as architects of opportunity, crafting a resilient future amid uncertainty and change.